Last week, it sure looked like the Uranium miners were preparing to rest, and we did get some pullback, but looking at the action today suggests the consolidation is ending. note, I did no call for or sell any of my positions, but was hoping for a deeper pullback to buy more. What has me excited is the jump in the Juniors. My notes are on the charts.

Monday, January 31, 2011

Sunday, January 30, 2011

Egypt - Into the Looking Glass

For this post I will only focus on the food problem for Egypt, and why it is a window on the demons released by our insane monetary printing, and the unwillingness of command and control countries to de-link from a parity dollar policy. The FED is pumping dollars to force China, et al to revalue, allowing for us to export and to raise tax funds and velocity through inflation. Unsustainable food and oil prices will force the hands of these governments to do just that, is the thinking. The game of chicken is on, but an unintended domino in a volatile part of the world fell this week, and has the potential to engulf us all.

Look at the slides and narrative from http://209.157.64.200/focus/f-news/2665495/posts?page=3 site. you can plug in nearly every North African/Middle Eastern country into this picture, but China, Russia, and India are also in the same boat. Add to this tight supply and the real likelihood that Russia, Canada, and Australia produce less than normal, and we have some big problems coming.

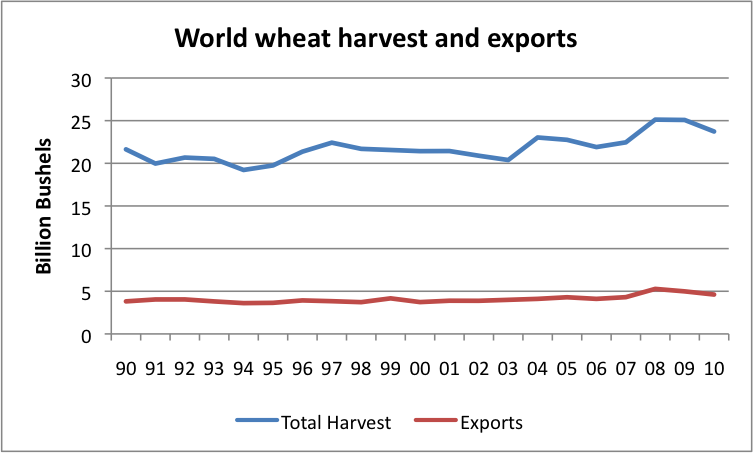

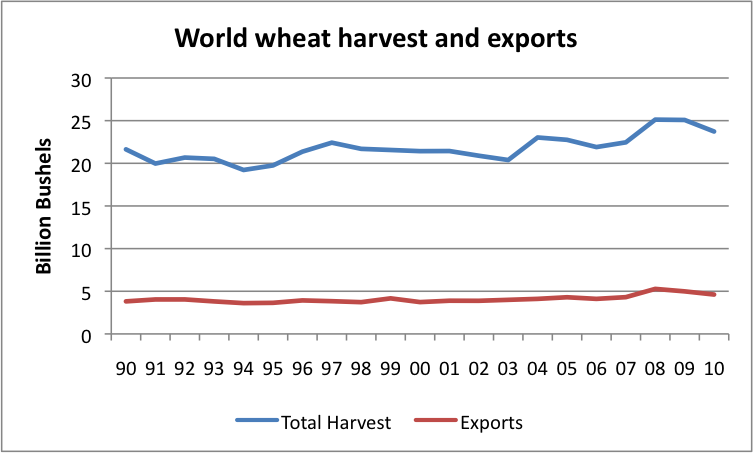

"Egypt is reported to be the world’s largest importer of wheat. In 2010, the oil minister stated that Egypt imports 40% of its food, and 60% of its wheat. The problem this year is that world wheat production is down (at least in part due to weather problems in Russia) so world exports are down:

Figure 4. World wheat production and world wheat exports from USDA

A longer term problem, though, is that world wheat production has not been growing to keep up with growing world population. Part of this lack of growth may be competition from bio fuels. Part of the lack of growth also relates to the fact that the “green revolution” improvements (adding irrigation and fertilizer) are mostly behind us. While irrigation and fertilizer greatly improved production at the time of the change, gains in production since 1990 have been much smaller.

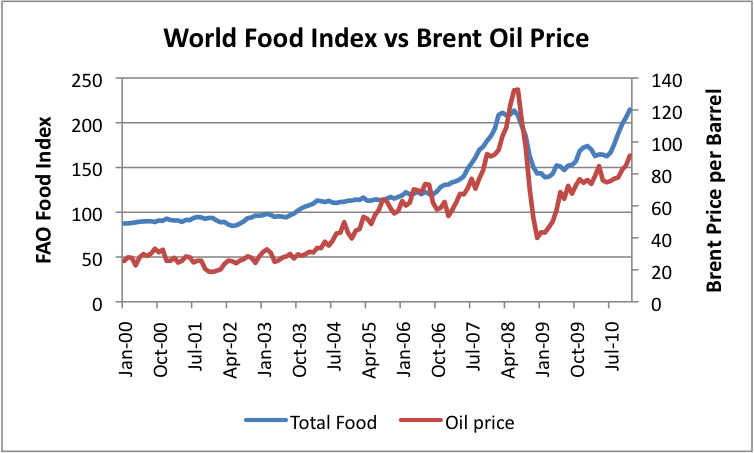

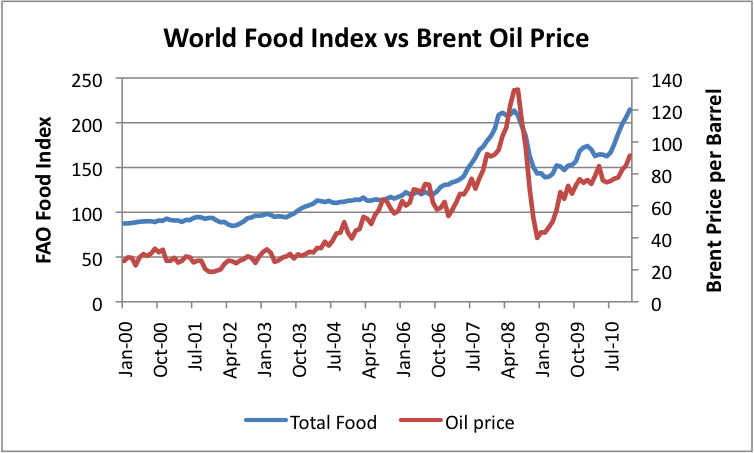

The cost of imported food, particularly wheat, has risen, partly because of the relatively smaller harvest, and partly because the cost of production and transport is rising because of rising oil prices. Figure 5 shows the close relationship food prices and oil prices. The Food Price Index used in this graph is the FAO’s Food Price Index related to food for export; Brent oil prices are spot prices from the EIA.

Figure 5. World food price trend is similar to Brent oil price trend.

With oil prices higher now (because world production is close to flat, and as countries come out of recession, they want more), food prices of all types are higher as well. Oil is used directly in the production of grain and indirectly in storage and transit, so its cost becomes important.

The higher food prices contribute to the overall inflation problem that Egypt already had. In 2010, the CIA Factbook estimated the inflation rate to be 12.8%. Since wages don’t always rise to match inflation rates, inflationary pressures have no doubt put more pressure on the government to increase subsidies, at a time it cannot really afford to do so.

Impact on the Rest of the World

Why does everyone else respond so strongly to Egypt’s problems?

One reason is that other Arab countries are also feeling some of the same pressures. Food prices are rising everywhere. Many low income people spend in excess of 50% of their income for food, so a rise in food costs becomes a real issue. People have come to depend on oil and food subsidies. If they are taken away, or not raised sufficiently to compensate for the higher costs of imports, it is a real problem.

Oil prices seem to be affected as well. If the Suez Canal should be closed because of disruptions, it could affect oil transit, particularly to Europe. According to the EIA:

The inability to send products southbound through the Suez Canal is likely to also be a problem. Part of what Europe does is refine oil, keep the products it needs, and send other products to customers elsewhere. The whole system is set up assuming close to “just-in-time” production and delivery. While there is some storage capability, after a few days or weeks the system is likely to start running into problems. Those in need of the refined products being sent southward through the Suez Canal will be facing a shortage, and Europe will have excess supply. Of course, it is possible to use longer shipping routes, but this uses more oil for shipping and takes longer, so is more expensive. There is also a time-delay when the new system is put in place.

All of these problems (relating to both north and south-bound oil traveling through the Suez) can be worked around, but there could be a period of disruption for a while, as supplies begin traveling a longer route."

If you have not already, I suggest buying MOO, RJA, JJG, and DBA on any weakness. The revolutions may end, but not the food crisis.

Look at the slides and narrative from http://209.157.64.200/focus/f-news/2665495/posts?page=3 site. you can plug in nearly every North African/Middle Eastern country into this picture, but China, Russia, and India are also in the same boat. Add to this tight supply and the real likelihood that Russia, Canada, and Australia produce less than normal, and we have some big problems coming.

"Egypt is reported to be the world’s largest importer of wheat. In 2010, the oil minister stated that Egypt imports 40% of its food, and 60% of its wheat. The problem this year is that world wheat production is down (at least in part due to weather problems in Russia) so world exports are down:

A longer term problem, though, is that world wheat production has not been growing to keep up with growing world population. Part of this lack of growth may be competition from bio fuels. Part of the lack of growth also relates to the fact that the “green revolution” improvements (adding irrigation and fertilizer) are mostly behind us. While irrigation and fertilizer greatly improved production at the time of the change, gains in production since 1990 have been much smaller.

The cost of imported food, particularly wheat, has risen, partly because of the relatively smaller harvest, and partly because the cost of production and transport is rising because of rising oil prices. Figure 5 shows the close relationship food prices and oil prices. The Food Price Index used in this graph is the FAO’s Food Price Index related to food for export; Brent oil prices are spot prices from the EIA.

With oil prices higher now (because world production is close to flat, and as countries come out of recession, they want more), food prices of all types are higher as well. Oil is used directly in the production of grain and indirectly in storage and transit, so its cost becomes important.

The higher food prices contribute to the overall inflation problem that Egypt already had. In 2010, the CIA Factbook estimated the inflation rate to be 12.8%. Since wages don’t always rise to match inflation rates, inflationary pressures have no doubt put more pressure on the government to increase subsidies, at a time it cannot really afford to do so.

Impact on the Rest of the World

Why does everyone else respond so strongly to Egypt’s problems?

One reason is that other Arab countries are also feeling some of the same pressures. Food prices are rising everywhere. Many low income people spend in excess of 50% of their income for food, so a rise in food costs becomes a real issue. People have come to depend on oil and food subsidies. If they are taken away, or not raised sufficiently to compensate for the higher costs of imports, it is a real problem.

Oil prices seem to be affected as well. If the Suez Canal should be closed because of disruptions, it could affect oil transit, particularly to Europe. According to the EIA:

An estimated 1.0 million bbl/d of crude oil and refined petroleum products flowed northbound through the Suez Canal to the Mediterranean Sea in 2009, while 0.8 million bbl/d travelled southbound into the Red Sea.The amounts being transported through the Suez canal are now likely down a little from these amounts in 2011, because of reduced imports/exports worldwide, but they are still substantial. Europe’s oil imports are about 10 million barrels a day of oil, according to Energy Export Data Browser (using BP’s data). If all of the amounts that flowed northbound went to Europe, they would amount to about 10% of Europe’s imports, or about 7% of Europe’s consumption. In fact, some of these exports go farther–in particular to the US, or to Canada, so the amount in question is probably lower than this relative to Europe’s consumption, say 4% or 5%. But even a small shortfall is a problem, in a world that needs oil for transport, food production, heating, and many other uses.

The inability to send products southbound through the Suez Canal is likely to also be a problem. Part of what Europe does is refine oil, keep the products it needs, and send other products to customers elsewhere. The whole system is set up assuming close to “just-in-time” production and delivery. While there is some storage capability, after a few days or weeks the system is likely to start running into problems. Those in need of the refined products being sent southward through the Suez Canal will be facing a shortage, and Europe will have excess supply. Of course, it is possible to use longer shipping routes, but this uses more oil for shipping and takes longer, so is more expensive. There is also a time-delay when the new system is put in place.

All of these problems (relating to both north and south-bound oil traveling through the Suez) can be worked around, but there could be a period of disruption for a while, as supplies begin traveling a longer route."

If you have not already, I suggest buying MOO, RJA, JJG, and DBA on any weakness. The revolutions may end, but not the food crisis.

Saturday, January 29, 2011

Silver Bells

For the past month Silver has retraced some amazing gains, pretty aggressively, I may add. But looking at the chart of the miners I selected below, it sure looks like consolidation to me, on the verge of a new upleg.

Up until the unrest in Tunisia became a contagion in Egypt, I was in the camp of silver going to the $24-25 dollar range, and planned on holding any new purchases until the latter part of February to let that scenario play out.

In March, silver the open interest is growing incredibly, and in that OEX the buyers can demand the physical. Also, investors are emptying the Comex of inventory. My view is speculators sensing a squeeze will start putting upward pressure on the metals after the February OEX closed.

Now back to North Africa, this is a game changer, people are being reacquanted with risk, and the Precious metals benefit from this. Also, I cannot see a short term scenario that stops the FED from doubling our money supply again in the next twelve months, So I started buying back into my silver positions this week.

Below, I present three companies for you, AG is a core holding, and above $12.40 I will complete my buy program (gap fill and hold), EXK, I think has already broken out, and added to already. Finally, HL, it looks like AG's chart (I do not own it).

Up until the unrest in Tunisia became a contagion in Egypt, I was in the camp of silver going to the $24-25 dollar range, and planned on holding any new purchases until the latter part of February to let that scenario play out.

In March, silver the open interest is growing incredibly, and in that OEX the buyers can demand the physical. Also, investors are emptying the Comex of inventory. My view is speculators sensing a squeeze will start putting upward pressure on the metals after the February OEX closed.

Now back to North Africa, this is a game changer, people are being reacquanted with risk, and the Precious metals benefit from this. Also, I cannot see a short term scenario that stops the FED from doubling our money supply again in the next twelve months, So I started buying back into my silver positions this week.

Below, I present three companies for you, AG is a core holding, and above $12.40 I will complete my buy program (gap fill and hold), EXK, I think has already broken out, and added to already. Finally, HL, it looks like AG's chart (I do not own it).

Thursday, January 27, 2011

Uranium miners - Ready for a Retrace

The uranium miners have held up pretty well so far, and have a bright year ahead of them, but the miners are now the most stretched to their 200 EMA and are either bumping the tops of channels or are showing some softness. My intent is to double down over the next two months. These are my core holdings, and at core position size, I will sell call spreads to ease the pain, if they break down.

Wednesday, January 26, 2011

Anatomy of a Trade - FCX

Looking for day trades, using the 15 minute chart, I watch the MACD and the 10 and 30 EMA. For FCX, I was actually looking for a place to short it again as it under the 20 and 50 EMA and the MACD was pointing down, I was looking for a rejection at the 10 EMA, but MACD flat lined, then got stronger, then crossed, so I held off. This morning the EMA 10 and 30 crossed with a rising MACD so I took the trade and rode it all day. I am still in it as MACD is still pointing up and the price has not penetrated the MA (30) nor have they crossed.

Longer term this is still a sell until it rises above the 20 again.

Longer term this is still a sell until it rises above the 20 again.

Tuesday, January 25, 2011

Food Inflation - More Than Meets the Eye

As the mainstream public and media starts grasping the significance of rising food prices around the world, their focus, and the focus of most people is on how terrible it is for poor people or for poor countries, but this problem is more insidious, and damaging for our economy.

Taking a step back, one of the goals of the Fed is to force velocity of money by raising prices, especially necessities, thus creating the whirlwind of economic activity that can be taxed and diverted to the bankers. In their mind they solve two problems in one for themselves, and cause some inconvenience along the way for masses.

But we are not in a demand push inflation, but a cost push variety with no increase in domestic income, but more importantly, they are neglecting Maslows laws of well being; specifically when people start to worry about food security and in our case ability to pay for food, a multiplier effect takes hold; in the wrong direction. People shut down when pursuing safety.

In my view food, and for purpose of this post, is non prepared grocery food, and it is low margin and low velocity. As prices in the market go up, and wages do not, the first effect is rolling down from restaurant eating, then the high margin prepared foods in the market are targeted. This brings us to today, going forward the next roll down is from discretionary food items, and label brands to basics and store brands.

Now it gets interesting, as food and fuel push up from here, the next area is discretionary other spending, which rips into the heart of our service economy, margin squeezes on everything not essential will happen first, then these businesses will simply give up and close.

My point is as people focus on basics, and worrying about the future cost of said basics, they are less likely to have the animal spirits to create the velocity the FED desires, buying food instead of something else is not simply a one for one substitution of expense in the family budget, and replacing high margin spending with low margin ones, does not drive us out of this ditch, it perpetuates it.

It is ironic to me that every business in this country either becomes a non profit or extinct, so the bankers can be made whole. Where is the CEO outcry?

Taking a step back, one of the goals of the Fed is to force velocity of money by raising prices, especially necessities, thus creating the whirlwind of economic activity that can be taxed and diverted to the bankers. In their mind they solve two problems in one for themselves, and cause some inconvenience along the way for masses.

But we are not in a demand push inflation, but a cost push variety with no increase in domestic income, but more importantly, they are neglecting Maslows laws of well being; specifically when people start to worry about food security and in our case ability to pay for food, a multiplier effect takes hold; in the wrong direction. People shut down when pursuing safety.

In my view food, and for purpose of this post, is non prepared grocery food, and it is low margin and low velocity. As prices in the market go up, and wages do not, the first effect is rolling down from restaurant eating, then the high margin prepared foods in the market are targeted. This brings us to today, going forward the next roll down is from discretionary food items, and label brands to basics and store brands.

Now it gets interesting, as food and fuel push up from here, the next area is discretionary other spending, which rips into the heart of our service economy, margin squeezes on everything not essential will happen first, then these businesses will simply give up and close.

My point is as people focus on basics, and worrying about the future cost of said basics, they are less likely to have the animal spirits to create the velocity the FED desires, buying food instead of something else is not simply a one for one substitution of expense in the family budget, and replacing high margin spending with low margin ones, does not drive us out of this ditch, it perpetuates it.

It is ironic to me that every business in this country either becomes a non profit or extinct, so the bankers can be made whole. Where is the CEO outcry?

GORO - Hammer Time

GORO is the blue chip gold mining company. Smart management, discipline capital allocators, tight share structure, and a monthly dividend. When it collapsed into the open, I grabbed a bull put spread on and, and also bought some 22.50 calls. Now, it looks like a nice hammer forming.

I am playing this for a run to the 50 EMA.

I am playing this for a run to the 50 EMA.

SPY - Correction Underway

Per my earlier post on SPY, I have waited for SPY Stochs to begin to break down and for momentum to rollover. Today is the day. I can now trade weekly options on my SPY so I have long puts Feb and March and will hedge weekly short puts. My view is this correction will be greater than average for this period. You can peruse my earlier posts as to why I feel that way.

Monday, January 24, 2011

WHY I am Shorting FSLR

FSLR always ramps into earnings, I am speculating they will again this time, as well. I bought Feb 145 puts Friday and today. In 2011 headwinds in margins and in increased production out of China, and lower subsidies across the board will make it difficult to show profitable growth. I have stops set, but will reshort if I am early and get blown out.

Saturday, January 22, 2011

A Prediction Fullfilling

Last March I wrote my first post for Tim Knight over at The Slope of Hope and discussed what can stop the Fed. At the time we were going through our second bout of uninterrupteded ramping in the market, and I speculated on what will kill the economy. Please read here for the post

http://slopeofhope.com/2010/03/index.html

At the time the price of oil was $81, the price of gold $1130, and the interest rates were 3.7%. In one short year, all of the levers that will kill the Fed's ability to strengthen the economy through more debt are now pushing hard against them, and are at breaking points for the economy.

In addition, our inconvenience in these areas of price increases are turning into calamities overseas. China and India are experiencing food inflation that, in my view cause world changing social unrest. South Korea is releasing emergency food stockpiles to ease pricing pressures, North Africa is experiencing regime change, and the other two BRIC countries, Brazil and Russia are suffering from these same hot money flows. Oh, and don't forget Europe. We are one bad harvest away from a worldwide upheaval (a post for another day)

All of this calamity because the TPTB are protecting the bank and other fixed income bondholders. All of the extra money created worldwide is being used to buy hard assets (and being hoarded) with the fake money, and the money is being politically directed. So in the end, the imbalances continue until the masses here in the U.S. can't absorb the costs anymore. That time has come; as I always contend, the price of energy is the silver nail into the Fed. Food and transport companies are getting crushed via margin pressure, and they will release that pressure onto us. As that happens (already begun) the political heat ends the games and the long awaited debt destruction spiral can and will begin.

My bias is that we profit correct out of this quarter, the politicians panic regarding the Muni crisis, and we move into our last bout of the bubble, then it gets ugly.

Enjoy your weekend :-), and go Steelers.

http://slopeofhope.com/2010/03/index.html

At the time the price of oil was $81, the price of gold $1130, and the interest rates were 3.7%. In one short year, all of the levers that will kill the Fed's ability to strengthen the economy through more debt are now pushing hard against them, and are at breaking points for the economy.

In addition, our inconvenience in these areas of price increases are turning into calamities overseas. China and India are experiencing food inflation that, in my view cause world changing social unrest. South Korea is releasing emergency food stockpiles to ease pricing pressures, North Africa is experiencing regime change, and the other two BRIC countries, Brazil and Russia are suffering from these same hot money flows. Oh, and don't forget Europe. We are one bad harvest away from a worldwide upheaval (a post for another day)

All of this calamity because the TPTB are protecting the bank and other fixed income bondholders. All of the extra money created worldwide is being used to buy hard assets (and being hoarded) with the fake money, and the money is being politically directed. So in the end, the imbalances continue until the masses here in the U.S. can't absorb the costs anymore. That time has come; as I always contend, the price of energy is the silver nail into the Fed. Food and transport companies are getting crushed via margin pressure, and they will release that pressure onto us. As that happens (already begun) the political heat ends the games and the long awaited debt destruction spiral can and will begin.

My bias is that we profit correct out of this quarter, the politicians panic regarding the Muni crisis, and we move into our last bout of the bubble, then it gets ugly.

Enjoy your weekend :-), and go Steelers.

Friday, January 21, 2011

Silver is in Backwardation

Per James Turk.

"Silver is in backwardation not just in the short-term, this time it is extending twelve months forward!

"Silver is in backwardation not just in the short-term, this time it is extending twelve months forward!

The last time this happened Eric was in January of 2009. Over the next few weeks silver rose from about $10.50 to $14.50, a roughly a 40% move higher. The key to understanding backwardation is that the price must rise to entice holders of physical metal to sell and accept a national currency in return. I think we can expect a similar event to repeat over the next few weeks.

A similar type of move would clearly put silver well above its previous high. What this backwardation shows is that there is a disconnect between the physical and the paper markets in silver. As I said previously, the silver shorts simply cannot hold the paper price down here any longer without seriously discrediting the paper silver market as a price discovery mechanism.

Gold is not in backwardation, nevertheless the demand for physical gold is extremely intense. With the sentiment ".

If we get fireworks they will start next week, but will explode in March when the exchanges must deliver physical vs just rolling them over.

I have been buying silver junior miners on every significant down day. EXK and AG are my choices. I intend to ride this next wave higher in silver with a very large SLW call position, a position I will begin by buying 31 strike calls and selling 30/25 puts. I will alternate between Feb and March. If the 50% retrace lines break, I will roll down strikes to 28 and 27/22 or 20. Any break back above the 20 EMA, and I will go agressively long again. Let' see what Monday brings.

MolyCorp Performing as Expected

Next week MCP has insider lock up ending. Their current public float to total share is only 25%. This is not bullish. couple this with weakening metal pricing, and sell danger zone for stocks, I am expecting new lows.

The chart is giving great trading ranges. I am also short REE in sympathy, as the Rare Earth ETF's will distribute as MCP fails.

The chart is giving great trading ranges. I am also short REE in sympathy, as the Rare Earth ETF's will distribute as MCP fails.

Tuesday, January 18, 2011

Tournigan cup is filled, handle or just break out

I own quite a few shares of this junior, and if it forms a handle and breaks out, I am doubling down.

UEC - Reloading

UEC has bounced off its channel and is readying another move higher. Look at the tight bollinger bands, and uranium prices up yet again this week. I already own my core position in this, I will run with some calls. URRE is also tightening on the BB.

They are Not Making it Easy

On Friday silver put in a hammer, signalling short term support. Silver and the dollar we are sitting at crucial support areas, and this morning silver is bouncing off that support and the dollar resting right on it. Where do we go from here?

We are in the zone for at least a correction in the stock market, yet the market is still strong, and the miners took an incredible beating. I am playing it cautiously, and will continue to buy junior silver miners on all significant dips in their price (> than 1%).

We are in the zone for at least a correction in the stock market, yet the market is still strong, and the miners took an incredible beating. I am playing it cautiously, and will continue to buy junior silver miners on all significant dips in their price (> than 1%).

Monday, January 17, 2011

SPY - Additional Data Points

A poster asked me to look at the price to 200 EMA for the period I covered in the last post. Below is the updated chart. We are stretched greater than average, but alas not predictive in determining how severe it the move down can be. Note to self, check your exuberance before you check your data points.

Some stats and the legend; green shading in the percent loss area is greater than average, green in the percent EMA means the stretch was higher than average, purple is when the 200 EMA was above price, and red is where the loss was less than average, but the EMA was stretched above average. Minimum loss was 7%.

Having said that, I still am of the view that the low volatility and persistent climb over that past seven weeks puts us in a fragile state, and APPL reporting on Jobs leaving, and some of the price blowups on the misses gives me confidence.

Some stats and the legend; green shading in the percent loss area is greater than average, green in the percent EMA means the stretch was higher than average, purple is when the 200 EMA was above price, and red is where the loss was less than average, but the EMA was stretched above average. Minimum loss was 7%.

Having said that, I still am of the view that the low volatility and persistent climb over that past seven weeks puts us in a fragile state, and APPL reporting on Jobs leaving, and some of the price blowups on the misses gives me confidence.

Saturday, January 15, 2011

SPY - Historical Perspective

To follow up on my last post, as we enter into the correction zone, what can we expect. The first chart I created looks back 11 years to give us some perspective. The findings are actionable; The market actually goes down during each of the first quarters examined. On average the moves are large enough and long enough to make a trade worth my while (36 days, 13 SPY points, 14% move).

My view is this correction will be longer and deeper than normal, as the price to 200 day is extremely stretched, and the run up has been particularly persistent, and calm.

Looking at the third chart informs me when I should make my move. Initial position when either MACD crosses or Stochs break the 70 line, and full position when both are triggered. Looking at the second chart, we find obvious support and a rising 200 day in the same area of past historical correction percentages.

So my trade is a 14 point March debit Put spread. I will use an initial stop loss, then look for a hammer or swing low to adjust or exit my trade.

My view is this correction will be longer and deeper than normal, as the price to 200 day is extremely stretched, and the run up has been particularly persistent, and calm.

Looking at the third chart informs me when I should make my move. Initial position when either MACD crosses or Stochs break the 70 line, and full position when both are triggered. Looking at the second chart, we find obvious support and a rising 200 day in the same area of past historical correction percentages.

So my trade is a 14 point March debit Put spread. I will use an initial stop loss, then look for a hammer or swing low to adjust or exit my trade.

Friday, January 14, 2011

SPY - Moving into the danger zone

Looking back at the last twelve months, SPY starts to sell off from the middle of the reporting month for about a month. I believe we are at extreme levels from the 200 EMA. Watch ya think?

Ready to double my FCX put

Yesterday my initial short signal on FCX hit, and I am in with Feb 115 puts. When the EMA 20 breaks, I will double my puts. I will get out when the 10 crosses the 30 to the upside.

Nitrogen - No Laughing matter

Farmers around the world need nitrogen to produce crops and it appears that investors are ready to continue to accumulate this stock. I like the yield, the monthly payout, and the that food prices are firm.

I have money rolling in from an investment that is now concluding, and I am adding TNH, along with SJT, and PVX to my yield fund.

I have money rolling in from an investment that is now concluding, and I am adding TNH, along with SJT, and PVX to my yield fund.

Thursday, January 13, 2011

Tournigan is Rocking

I spoke on this stock before and promptly bought 10,000 shares. Now it is moving nicely with Uranium prices. If you do not own it, you can bracket it by buying on the next dip and/ or buy on a break out. This stock will become a monster at some point.

I bought on the bounce out of the test of the loer band (see bottom chart). I am not getting cute trading uranium, I am just buying it on every logical opportunity.

I bought on the bounce out of the test of the loer band (see bottom chart). I am not getting cute trading uranium, I am just buying it on every logical opportunity.

Wednesday, January 12, 2011

From Lihua to Lihue if Correct

Lihua Copper has just completed a consolidation across its channel, and is moving higher. It also triggered an Elders buy signal. worth a shot long for me.

http://www.arum-geld-gold.blogspot.com/

http://www.arum-geld-gold.blogspot.com/

Elder Impulse Buy Signals

GLD, UEC, and CCJ hit Elder buy signals today. gold miners have been sluggish, and this may get them moving again. I will play them though with gold and silver junior plays (you may peruse my earlier posts on the stocks I like). Uranium is under no such restraint, I own a good bit of UEC (along with URRE, URZ, DNN, MWSNF, and TVCFF). I will push a little longer with additional shares or calls.

Tuesday, January 11, 2011

Moly Crunch

In five business days, the insiders for MolyCorp are allowed to sell their shares to the public, and having a company with no near term earnings prospects, a pricing model controlled by your competitors, selling for over 6 times book value, and a stock that is 300% of the IPO price, if you were an insider hedge fund, or executive, would you sell?

Now that the fever has broken on this stock, I am expecting at least a move back to the bottom of the channel. I am short via Feb 55 puts, and I am also short REE Feb 16 puts. I acquired and completed my purchases last week. Why REE? Well when folks start bailing out of MolyCorp, they are going to bail out of the ETF for Rare Earths, and REE will fall in simpatico.

Enjoy, and join me on the wild side :-)

http://www.arum-geld-gold.blogspot.com/

Now that the fever has broken on this stock, I am expecting at least a move back to the bottom of the channel. I am short via Feb 55 puts, and I am also short REE Feb 16 puts. I acquired and completed my purchases last week. Why REE? Well when folks start bailing out of MolyCorp, they are going to bail out of the ETF for Rare Earths, and REE will fall in simpatico.

Enjoy, and join me on the wild side :-)

http://www.arum-geld-gold.blogspot.com/

AG - Chemically Pleasing

First Majestic is a Junior Miner that I own, and is on a tear as a company. They now trade on the big Board, which will expose it to more investors, they should start trading options in the very near future, and today they announce increased production.

I am going to be buying this company on every pullback.

I am going to be buying this company on every pullback.

- Reports production up 62 pct in 2010 to 7 mln ounces

- Plans to boost 2011 production to 7.5 mln ounces

- First Majestic's total equivalent ounce production represents 6.5 million ounces of silver, 6.4 million pounds of lead and 2,152 ounces of gold.

- First Majestic said that expansion of its Parrilla mine in Mexico and operational improvements at two other mines would boost output in 2011.

Sunday, January 9, 2011

Saturday, January 8, 2011

Are We at Deflations Gate?

In December my indicators told me to move into a short position regarding the miners, especially gold, and I did so. Then during the Christmas break, the strength of the move forced me to dehedge and go longer, which I did. So far so good on that, made some nice money and was feeling good going into the new year.

This week I spent the better part of it very sick and scrambling to sell things and rehedge, as I think I was hoodwinked by greed, and not paying enough attention to the low volume week, and its implications.

As part of my reflection, I started to look at charts from December 09 to see how the miners, and commodities in general have done in this so called stimulated environment. Some interesting finds.

The large cap miners have done nothing, while gold is up 11%, this can't be good news for them if they break this horizontal support.

Oil has, ready, done nothing, and looking at USO, it was forming IHS, and has turned back on the neckline. I am watching this closely.

The dollar has gone nowhere, as well. Based on all that we are hearing about stimulus, you'd think the dollar is in the tank, nope.

The Euro, is down, and looks ready for the next leg down right now. This cannot be good for the stock market.

What is up is food and copper, food I can understand, poor harvests, small commodity markets that can be overwhelmed with hot mney, etc. Copper though is interesting, best I can guess, it is all about China, or is it. I also hear that JP Morgan is controlling 80% of the metal in Comex, and has it warehoused, maybe a hedge against their silver exposure short. If silver relents lower here, watch copper, also the China growth story is long in the tooth. I am shorting FCX below its 20EMA.

We may be in a position for our next whiff of deflation, what say you?

some charts

This week I spent the better part of it very sick and scrambling to sell things and rehedge, as I think I was hoodwinked by greed, and not paying enough attention to the low volume week, and its implications.

As part of my reflection, I started to look at charts from December 09 to see how the miners, and commodities in general have done in this so called stimulated environment. Some interesting finds.

The large cap miners have done nothing, while gold is up 11%, this can't be good news for them if they break this horizontal support.

Oil has, ready, done nothing, and looking at USO, it was forming IHS, and has turned back on the neckline. I am watching this closely.

The dollar has gone nowhere, as well. Based on all that we are hearing about stimulus, you'd think the dollar is in the tank, nope.

The Euro, is down, and looks ready for the next leg down right now. This cannot be good for the stock market.

What is up is food and copper, food I can understand, poor harvests, small commodity markets that can be overwhelmed with hot mney, etc. Copper though is interesting, best I can guess, it is all about China, or is it. I also hear that JP Morgan is controlling 80% of the metal in Comex, and has it warehoused, maybe a hedge against their silver exposure short. If silver relents lower here, watch copper, also the China growth story is long in the tooth. I am shorting FCX below its 20EMA.

We may be in a position for our next whiff of deflation, what say you?

some charts

Subscribe to:

Posts (Atom)