There appears to be a lot of cross currents right now. I hold no equities in my trading account and am only in options and they are mostly credit spreads. Europe dominates, with U.S. and Chinese weakness starting to come to the fore.

I think we move higher this week in anticipation of the Euro summits. I will be in scalping mode only. In two weeks earnings season starts, and I can't imagine that a stronger dollar and a weaker economy brings enthusiasm to hold stocks. So no need to rush into positions, unless one of the CB's around the world announce pumps money. Below are my charts.

Sunday, June 24, 2012

Saturday, June 16, 2012

The Boring, upcoming week ahead

Greece, Egypt, Fed, and now Saudi Arabia in the news. We are dancing around a lot of geopolitical issues. Don't forget France on Saturday. These news events are important, but it appears that Fed and ECB liquidity is all that matters.

gold and silver will take their cues from the Fed, the miners may need a pause here, oil is Sybil, not knowing where to go, and commodities are getting a bid.

I am positioned for more liquidity, and will enter more energy positions as they continue to break out. My trades active this week are doing well, and I trimmed size and moved up stops to ensure profitability. See below. I posted a lot of charts with comments attached, enjoy, and comments are appreciated.

gold and silver will take their cues from the Fed, the miners may need a pause here, oil is Sybil, not knowing where to go, and commodities are getting a bid.

I am positioned for more liquidity, and will enter more energy positions as they continue to break out. My trades active this week are doing well, and I trimmed size and moved up stops to ensure profitability. See below. I posted a lot of charts with comments attached, enjoy, and comments are appreciated.

Saturday, June 9, 2012

la próxima semana June 10th 2012

My thoughts are noted on the charts themselves, but it sure appears to me that a huge relief rally is in process. My view is, contrary to all of the posturing, printing will be occurring in all the major currencies.

China started the ball rolling, Japan is always on board, Europe started Saturday with the Spanish bailout, and the FED will be buying up Treasuries and MBS, whether they announce it or not. I'd be surprised if the lows last week are taken out without a strong move higher first.

My longer term buy / sell signals on the metals, energy and the broad market are still flashing a sell, but they do lag a week or so, evidence of that, with gold and the market showing huge short covering moves in the last ten days. The miners have already flashed a buy and dip buying is my plan.

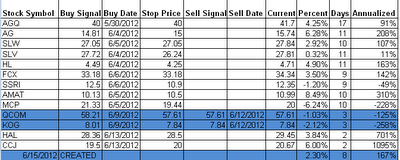

Regarding my published trades, you can see the score below, but I also trade options and have been doing very well in shorting the leveraged ETF's on big moves higher or trend changes. The robots are mean reverting a lot and it makes for a relatively easy trade. FAZ, DUST, and TZA have been my prey. I also am doing a lot of condors inside of these support resistance lines. My directional bets with GLD and SLV have been losers, but mitigated with selling calls against them with weeklies. They are July's and are at or in the money for the most part. I have high hopes for them.

My trade performance from my signals Y-T-D is 26% on 130 trade signals, my current trades are below. My AGQ trade performance is up 387% from August 2010, and we are currently long in the trade. $20K reinvested on all buy and sells is worth $216,294, sans commission and taxes. Enjoy the charts and feedback is appreciated.

China started the ball rolling, Japan is always on board, Europe started Saturday with the Spanish bailout, and the FED will be buying up Treasuries and MBS, whether they announce it or not. I'd be surprised if the lows last week are taken out without a strong move higher first.

My longer term buy / sell signals on the metals, energy and the broad market are still flashing a sell, but they do lag a week or so, evidence of that, with gold and the market showing huge short covering moves in the last ten days. The miners have already flashed a buy and dip buying is my plan.

Regarding my published trades, you can see the score below, but I also trade options and have been doing very well in shorting the leveraged ETF's on big moves higher or trend changes. The robots are mean reverting a lot and it makes for a relatively easy trade. FAZ, DUST, and TZA have been my prey. I also am doing a lot of condors inside of these support resistance lines. My directional bets with GLD and SLV have been losers, but mitigated with selling calls against them with weeklies. They are July's and are at or in the money for the most part. I have high hopes for them.

My trade performance from my signals Y-T-D is 26% on 130 trade signals, my current trades are below. My AGQ trade performance is up 387% from August 2010, and we are currently long in the trade. $20K reinvested on all buy and sells is worth $216,294, sans commission and taxes. Enjoy the charts and feedback is appreciated.

Sunday, June 3, 2012

My thoughts for the week ahead

Pretty much everything did as was expected last week, according to the charts. Emotionally, I was not as confident. GLD has broken out, now I expect it to start stair stepping at least to the February highs, I am long calls.

The miners have successfully tested and are moving higher, probably much higher. I am now going to widen my stops on positions I am still in, and will do so for others I enter. . I will enter SLW, EGO, SSRI, RIC and AG this week.

SLV has not yet broken out, above 28.14 triggers my buy signal. I am doubling my calls, July 27's.

Oil is a mess, and I think it still has room to fall, however I went long HAL (buy signal hit at 30.05) Friday on two successful tests and it getting bid up all day, the last two days.

SPY broke its bear flag, I closed my lower Condor legs, and bought puts on SPY and on FAS on Thursday. I closed FAS but kept SPY. I can see SPY fall to 121 area, but if it reverses, I am going long high beta, SPY calls and banks to a short covering rally.

For those following my signals below is the spreadsheet of open trades and trades closed this week. I also posted charts for your review. It will be an interesting week.

For the year I am up 36% on my buy signal trades.

The miners have successfully tested and are moving higher, probably much higher. I am now going to widen my stops on positions I am still in, and will do so for others I enter. . I will enter SLW, EGO, SSRI, RIC and AG this week.

SLV has not yet broken out, above 28.14 triggers my buy signal. I am doubling my calls, July 27's.

Oil is a mess, and I think it still has room to fall, however I went long HAL (buy signal hit at 30.05) Friday on two successful tests and it getting bid up all day, the last two days.

SPY broke its bear flag, I closed my lower Condor legs, and bought puts on SPY and on FAS on Thursday. I closed FAS but kept SPY. I can see SPY fall to 121 area, but if it reverses, I am going long high beta, SPY calls and banks to a short covering rally.

For those following my signals below is the spreadsheet of open trades and trades closed this week. I also posted charts for your review. It will be an interesting week.

For the year I am up 36% on my buy signal trades.

Subscribe to:

Posts (Atom)