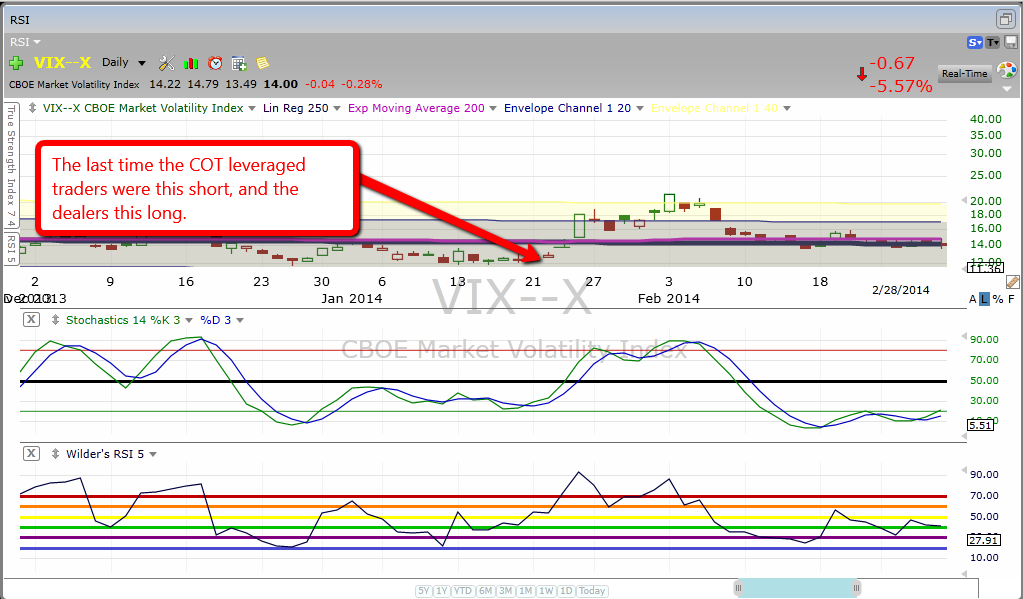

I spent a great deal of time reviewing the historical volatility action and the relationship with the indexes. There is an obvious inverse relationship, but are there any signals that tell me to look for reversals. Looking at the COT data, and the intensity of the leveraged money positions, I think I have found something trade-able.

Whenever the VIX is oversold and the percentage of long dealers to leveraged short Money Managers hits 35% or lower the VIX and the stock market both reverse within two weeks. In addition, this time the amount of leveraged shorts is at the highest in open contracts this year.

One other thing I noticed is that the number of leveraged contracts in 2013 far exceeded the average so far this year. I must assume that as the FED eased off credit printing, the market players used this funding mechanism less, and the stock market flat-lined.

I am and remain long volatility, and short the market until this ratio moves back into the 50% or greater range.

bonus chart, CSX looks ready to move higher again.

Enjoy the charts, and click to enlarge.

It is better to search and algorithm search on an ongoing basis by any government agency or 'empowered' person for Gold Trading Calls.

ReplyDeleteIt better to trade in stock market, under the guidance of Epic Research which is having a great technical and fundamental knowledge of market.

ReplyDelete